Overview

The Directors and Economists at Reserve Bank of India publish a monthly State of the Economy report in which they consolidate many economic indicators as well as numerous data points, focusing not only on Parameters in India but also Global indicators. In my opinion, this report is helpful for any analyst for understanding the macroeconomic factors and framing their projections for Financial Modelling.

As the report is very detailed, we will cover a few parts of the report in this short summary. Additionally, I’ll also cover some additional data points – both global and India which I find useful in my analysis.

Note – The charts in this summary are from the report itself and sources in each chart are provided as is.

Global Data

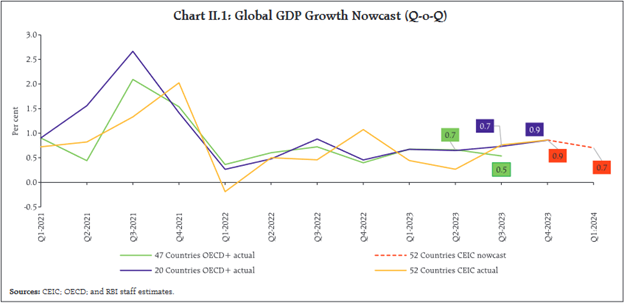

GDP Projections

Growth in Global GDP is slowing down, with a lot of advance economies (eg. Japan, UK, Ireland, Finland) in a technical recession, or are projected to go in a recession (Canada, New Zealand, Germany etc). There has been increased Geopolitical risk – tensions in the middle east, the ongoing Russia-Ukraine conflict as well as threat of escalations between US & China over China. These factors have led to an increase in pressure on supply chains in the recent months.

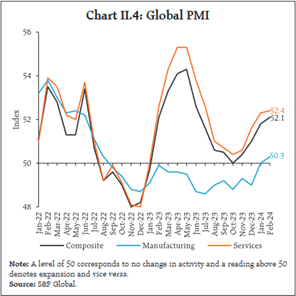

Purchasing Manager’s Index (PMI)

Global PMIs have been consistently above 50 in the past few months and momentum has gone up in 2024.

The global composite PMI increased to 52.1 in February 2024 – its highest reading since June 2023 – from 51.8 in January. The 6 subcategories recorded for the survey − business services; consumer goods and services; financial services; intermediate goods; and investment goods − recorded output increases simultaneously for the first time since May 2023. The services PMI rose to a seven-month high of 52.4 in February, driven by faster rate of growth in business activity. After almost 18 months of a sub 50 reading, the manufacturing PMI returned to the expansionary zone at 50.3.

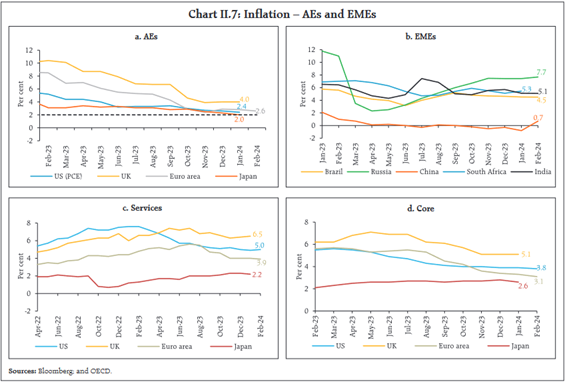

Inflation

Inflation has moderated from the highs of 2022 and 2023, with moderation resulting from a variety of factors – supply chains have gotten back in line from the COVID disruptions, global tightening in interest rate policies across all major economies etc. My Opinion – Inflation will remain elevated (compared to Advance Economies’ Targets) and Central banks policy will remain tight in the near term.

India

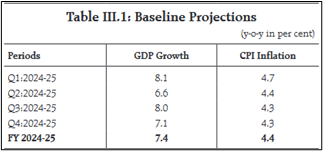

GDP Growth and Projections

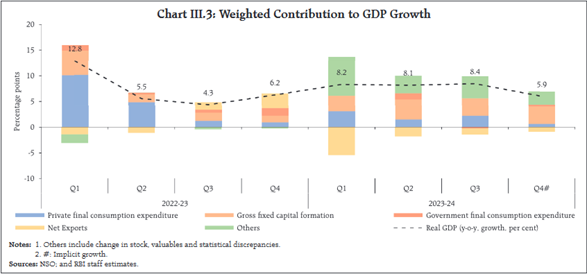

RBI projects a strong 7.4% growth for the Indian Economy and Inflation moderating to 4.4%, very close to the RBI target of 4%. At 7.4%, India is projected to be the fasting growing large economy in the world for the next year.

The Second Advance (SAE) estimate for India’s GDP growth, released in February 2024 by the NSO was at 7.6%, 30 bps higher than the first advance estimate (FAE). The driving reasons for the same are an upward revision in the Gross Capital Formation and lower drag from Net Exports.

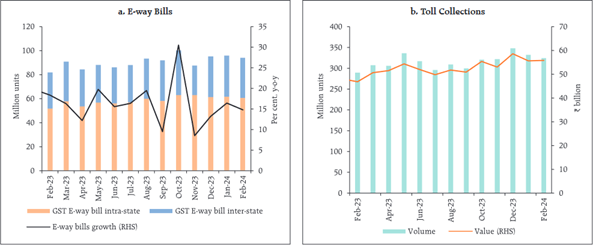

Domestic Demand remains robust in February 2024, with E-way bills registering a 14.8% growth YoY and toll collections were up 15.1% YoY. (Source: GSTN and RBI)

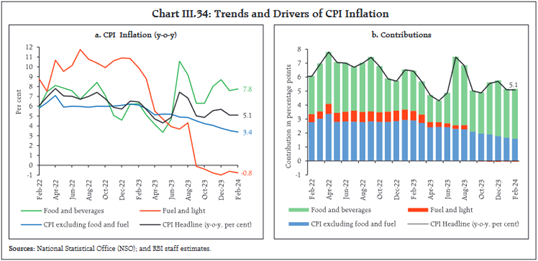

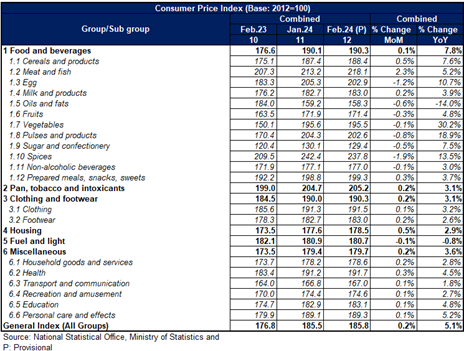

Consumer Price Index

The CPI has moderated from the highs of 2023 (>7%) to 5.1%, owing to stabilization of global fuel prices. However, the Food and Beverage category remains elevated, with an increase of 7.8% YoY compared to February 2023.

A breakdown of the combined inflation can be found below:

The detailed weight allocation for the different Groups and Subgroups can be found at https://mospi.gov.in/percentage-share

You can also find additional information on Inflation and CPI by going through one of my older articles at https://magarwal.substack.com/p/inflation

Import-Export

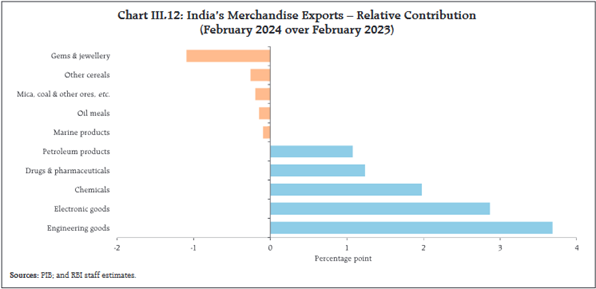

India’s merchandise export clocked at $41.4B for the month of February 2024, an eleven-month high and grew by 11.9% YoY for a third consecutive month. Out of the 30 commodities in the export basket, 22 registered a growth YoY. Strong growth was registered in Electronic Goods, Engineering Goods, Petroleum Products and Chemicals, where Gems & Jewellery, Cereals, Mica, Coal etc caused a drag on the exports.

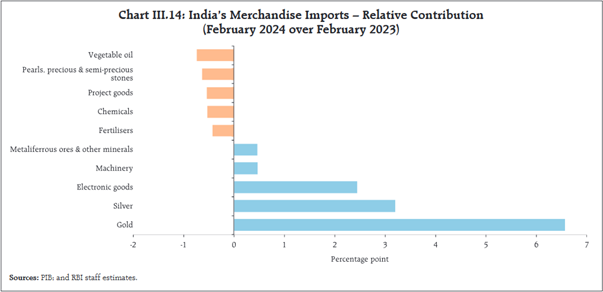

Merchandise Imports widened to $60.1B in February, leading to a growth of 12.2%. Out of the 30 commodities, 17 registered growths. Precious metals – Silver and Gold as well as Electronic Goods grew the most, while Vegetable oil, Chemicals, Fertilizers contracted YoY.

Note: Gold is currently trading at an all-time high and has crossed the $2,200 per ounce in March.

The merchandise trade deficit widened to $18.5B in February, compared to $16.5B in January.

Tax collection and Government Expenditure

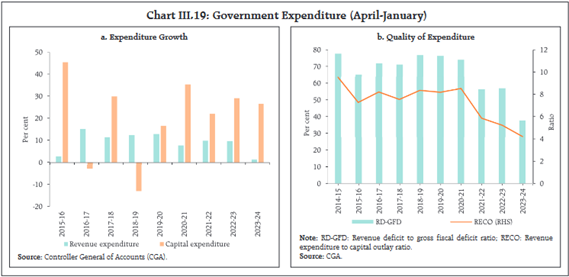

Direct tax collections grew by 23.5 per cent YoY during April-January 2023-24, with income tax collections growing at 27.3% and corporate tax collections at 20.1 per cent, respectively, reflecting increased compliance, higher advance tax collections and widening of the tax base. Non-Tax Revenue grew by 46.4% YoY primarily due to the higher than budgeted surplus transfer from the RBI. The non-debt capital receipts (mainly disinvestment receipts) contracted by around 40%. Overall, central government receipts grew up by 13.9%.

Government expenditure has also gone up year-on-year with the increase in higher tax collection. It is key to note that major growth in expenditure in the recent years has been primarily in Capital Expenditure and less on Revenue Expenditure. This is also reflected in the Quality of Expenditure ratio – Revenue expenditure/Capital Outlay, which has been reducing. (Lower is better). My Opinion – With a heavier focus on capital expenditure, the government not only creates job, but also helps develop lasting infrastructure, which provides a multiplier effect to the growth of the economy.

Vehicle and Retail Sales

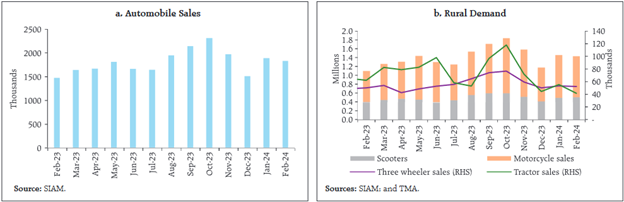

Automobile Sales registered a growth on 24.3% in Feb 24 (YoY). Two wheelers (Scooters and Motorcycles) have also registered a robust growth in Feb. However, three-wheeler sales remained flat and Tractors sales have reduced YoY. My understanding is this may suggest stress in the rural economy.

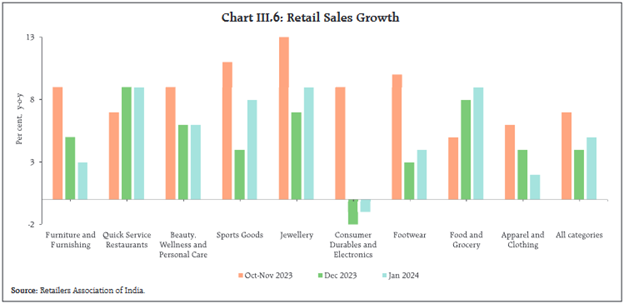

Retail Sales have registered a moderate growth in almost all sectors, except Consumer Durables and Electronics. My Opinion This data and the following charts are helpful in understanding what sectors are currently experiencing a strong growth, which in turn can help in shortlisting sectors for investments.

Corporate Sector Performance

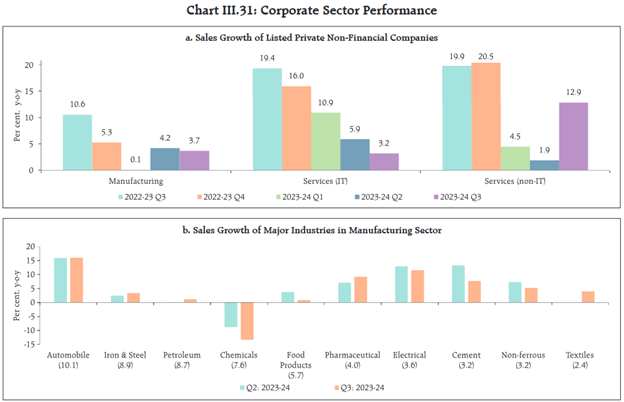

In the recent quarters, the growth in IT services industry has slowed owing to a slowdown in the Global Economy. Recently Accenture came out with a guidance for reduced earnings growth for 2024. This has also reflected in the Stock prices for IT stocks in India, with analysts reducing estimates for 2024-25.

However, the growth has picked up in non-IT services and manufacturing has also held up. RBI also provides a detailed breakdown of growth in different sectors for Manufacturing – Automobiles and Electricals have held up, while chemicals have contracted Y-o-Y in the recent quarters.

Source: Capitaline & RBI Staff estimates

This short summary captures only a few sections of the report. The entire report, which covers in detail – Labour Conditions, Agriculture, Payment systems to name a few can be found on the RBI Bulletin.

Do Share your comments!

-Manas Agarwal

Leave a Reply